National debt is not the people's debt - The country is not a company - Breakdown of government bond holdings that still do not penetrate public opinion.

2024-01-09

Category:Japan

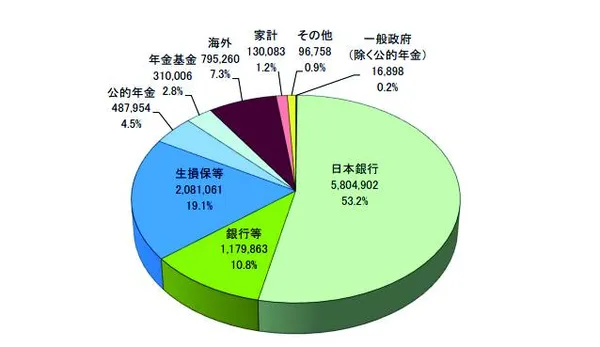

「国債等関係諸資料」令和5年6月末国債保有内訳 Photo by 財務省 (licenced by 財務省 )

I'm participating in the ranking.Please click and cheer for me.

National debt is not a national debt.

The image at the beginning shows the breakdown of Japanese government bond holdings. I sometimes see people say that national debt is the nation's debt or that it is the same as corporate debt, but national debt is the government's debt, not the people's debt. Even if a country is compared to a company, companies do not borrow money from their employees. Debt comes from outside the company, and in this case, it involves purchasing Japanese government bonds from overseas. If most of the debt is overseas, it is natural that the company will default if it cannot be repaid. Purchases of Japanese government bonds from overseas account for 7.3%.

The Japanese government has assets equivalent to its liabilities.

If you really want to say that it is the same as a company, would you say that purchases in Japan are borrowed and borrowed within the company or within the group company? Yoichi Takahashi considers the Bank of Japan to be the same as a subsidiary of the government, and explains that it is the same in terms of consolidation, regardless of whether interest is charged. The Bank of Japan holds 53.2% of Japanese government bonds. He is well known for introducing BS to show that the country holds government assets equivalent to the government's debts (excluding the holdings of the Bank of Japan). The total amount of government assets ranks first in the world, exceeding both the United States and China. Below is the balance sheet (BS) of Japan.

#img2#

Japanese government bonds are debt denominated in yen.

Furthermore, Japanese government bonds are mainly traded in yen, which means that there is no change in value based on foreign currencies. In the case of foreign currency transactions, if the value of your home currency plummets, the face value of your debt will rise accordingly. Suppose your country's currency drops to half its value. Alternatively, if the foreign currency used when trading government bonds doubles, the debt will also double, but since the transaction is in Japanese yen, there will be no effect at all. In an extreme case, former Prime Minister Aso said that repayment would be possible by increasing the number of yen bids. In this case, there will be inflation and the value of the yen will fall, but the theory is that the debt can be repaid because it is the face value of the yen. This was actually said by Taro Aso, a former Prime Minister and former Minister of Finance.

Japan, the world's largest creditor country

Secondly, the Japanese government is also the world's No. 1 creditor country. In other words, they have foreign bonds and foreign assets. The fact that we are currently talking about national debt as a problem is actually making a fuss about only the debt part, and in fact, Japan has the most foreign assets in the world. This assumes that the government bonds are denominated in yen as mentioned earlier, and if more yen is printed, the value of the yen will fall and the yen will become weaker. If you do this, overseas assets purchased in dollars or euros will increase in value when converted to yen, so the difference will be a large income. Even with the current depreciation of the yen, a large profit margin was generated due to the increase in the valuation of overseas assets.

Print more yen up to 2% inflation rate

Representative Sanae Takaichi has advocated the ``Japanese Economic Resilience Plan,'' which calls for a temporary freeze on primary balance (PB) regulations and calls for industrial investment through the issuance of government bonds. She says that even if inflation were caused by printing more yen, it would not have a big impact if the inflation rate was less than 2%. Currently, the yen is depreciating due to the difference in interest rates due to the Fed's interest rate hikes, but the original goal is to induce a depreciation of the yen through the issuance of government bonds and increase the number of bonds, strengthen international competitiveness, and increase wages and tax revenues through rising prices. If the manufacturing industry returns to Japan due to the weak yen, GDP and tax revenue will increase, and government debt can be reduced. For now, this is just the effect of a weaker yen due to interest rate differences, but we are already seeing significant results.

Read it together

Public opinion without examining Abenomics - there is no point in criticizing it based on contradictory premises.

There are some surveys and opinions in public opinion that Abenomics has ruined Japan, but is that true? First of all, what is Abenomics? Were you asking people who answered the same question as in the poll, or were you asking people you didn't know? I wonder if asking someone I don't know will give me the results I expected. First, let's review the three arrows of Abenomics.

Three arrows of Abenomics

Bold monetary policyFlexible fiscal policyGrowth strategy to stimulate private investment

Monetary policy is still ongoing, but former Prime Minister Abe has said that the consumption tax increase was decided in advance and was carried out at a time when it could not be postponed, so he was unable to fire a second arrow. In other words, Abenomics is actually the first arrow in a variety of environments. In other words, I would understand if there was an evaluation of the fact that it did not advance to the second stage, but I have doubts about evaluating Abenomics itself.

Next, I will list some of the achievements of Abenomics.

Main achievements of Abenomics

The total national and local tax revenue will reach a record high of 107 trillion yen in fiscal 2019, up from 78.7 trillion yen in fiscal 2012. The stock price, which was around 8,000 yen, rose to over 24,000 yen under the Abe administration. Public pension investment profits increased by 57.6 trillion yen in seven and a half years. The effective job opening ratio was 83 job openings for every 100 people in 2012, and 164 job openings for every 100 people in 2019. Business operators improved their treatment due to the labor shortage. The minimum hourly wage rose from 749 yen in 2012 to 901 yen in 2019. The rate of children from single-parent households going on to university increased significantly from 23.9% to 41.9%.

Sanaenomics (Japanese Economic Resilience Plan) will be published. Representative Sanae Takaichi announced a policy to carry on Abenomics during the last presidential election.

Sanaenomics three arrows

Financial easingFlexible fiscal stimulus in times of emergencyBold crisis management investment/growth investment

What they have in common is that monetary easing policy will continue, and if the Takauchi Cabinet is elected, the government will implement aggressive fiscal policy.

The fact that the Japanese government's balance sheet was introduced for the first time in 1995 means that the Japanese government did not have the concept of strategic investment, which companies take for granted. How can you invest without a balance sheet or cash flow statement? It was only a matter of being able to compare the income and expenditure for a single year, or the previous year. The term "primary balance" has come to be used like crazy. At that time, Japan believed that deregulation would revive the economy, and the government repeatedly took the approach of relaxing regulations through legal revisions.

As a result, the Japanese government was unable to rebuild the national economy or make strategic investments for economic growth after the collapse of the bubble, which was an unprecedented economic crisis. More than 30 years have passed since we stubbornly closed the doors. Then, companies moved their manufacturing sectors to emerging countries, and GDP and tax revenues mainly went to neighboring countries such as China, creating a dual wage structure of dispatched labor in order to prevent an increase in the number of unemployed people in Japan. . The economic disparity that arose from this process is said to be one of the causes of the current declining birthrate.

So, has Abenomics ruined Japan? Would that also mean denying Sanaenomics? Or will we continue to turn down investments from the government as we have been doing, paying close attention to the primary balance under the guidance of the Ministry of Finance and listening to the beautiful words of fiscal consolidation? The point of contention should be to gather opinions on whether or not bold fiscal spending by the government is necessary. In any case, regardless of whether the policy is better or not, there are parts where it seems like the point at issue is not policy at all, but just an extension of a personal attack, which is unfortunate.

30 years lost as a result of passive fiscal policy

In other words, those who claim that government debt is bad have the completely opposite idea. What ruined Japan after the bursting of the bubble was rather the primary balance discipline, the inability to focus on single-year income and expenditures and to make long-term investments. Japan tightened its finances in the most critical economic situation. If it is the same as a company, when the company is in crisis, the company's safe is closed like a shell, and for the past 30 years, the company has been operating in a state of poverty and not being able to make long-term investments. This is the so-called curse of PB by the Ministry of Finance.

I'm participating in the ranking.Please click and cheer for me.

Notes, condolence telegrams, and messages of condolence from leaders of various countries regarding the death of former Prime Minister Abe (added sequentially)

We will only post articles by current and past heads of state, prime ministers, etc. I will omit things at the Ministry of Foreign Affairs level. Since condolences also include posts on SNS, they will be written as "notebook," "condolence telegram," and "condolence message."

President Biden [United States of America] (bookkeeper)"It's a loss, not just to my family and the people of Japan, but to the world. A man of peace and decency, you will be missed." li>

Former President Trump [United States] (condolences)``His assassination is unforgivable. It's not just an atrocity, it's a tremendous loss to the entire world.'' ``He was a great leader. "A tough negotiator." "He has worked tirelessly for peace, freedom, and the irreplaceable bond between the United States and Japan." "I hope that we will pay a swift and heavy price for robbing the Earth of a great being. I wish.”

President Putin [Russia] (condolence telegram)“Respected Yoko AbeRespected Akie AbeYour son and husband Shinzo Abe We would like to express our deepest condolences on the passing of Mr. An outstanding politician who led the Japanese government for a long period of time at the hands of criminals and left many achievements in the development of good neighborly relations between Russia and Japan. I had regular contact with Shinzo, where his great personal and professional qualities were in full bloom.My memories of this remarkable man are the same as his. will remain forever in the hearts of everyone who knew him.With respect, Vladimir Putin"

President Tsai Ing-wen [Taiwan] (colored paper notes)“Taiwan’s eternal good friend, your contribution to Taiwan-Japan friendship and to democracy, freedom, human rights, and peace around the world. Thank you.”

Queen Elizabeth [Commonwealth] (condolence address to His Majesty the Emperor)“Our family is deeply saddened by the sudden and painful passing of former Prime Minister Shinzo Abe. It was clear that he loved him and wanted to strengthen his ties with Britain even closer than ever before. My deepest sympathies and sympathies go out to his family and to everyone in Japan."

Prime Minister Boris Johnson [United Kingdom] (Condolences)“Very sad news about former Prime Minister Shinzo Abe.The global leadership he demonstrated during these unprecedented times is... He will be remembered by many. Our thoughts are with former Prime Minister Shinzo Abe's family, friends and the people of Japan. Britain stands with you at this dark and sad time."

President Xi Jinping [China] (Condolences, Condolences)“On behalf of the Chinese government and the Chinese people, and in my own name, I would like to express my condolences to the untimely death of former Prime Minister Shinzo Abe. We express our ``deepest condolences'' and extend our condolences to Prime Minister Abe's bereaved family. "I once reached an important agreement with him on building Sino-Japanese relations that meet the requirements of a new era. I deeply regret his sudden death." "I will continue to work with the Prime Minister. We would like to continue to develop good neighborly relations and friendly cooperation between Japan and China in accordance with the principles established in the four Japan-China political documents.''

Prime Minister Modi [India] (Condolences)“I am shocked and saddened beyond words by the tragic passing of one of my closest friends. "He was a world-class statesman and an outstanding leader." "We met again on a recent visit to Japan and discussed many issues. He was as witty and insightful as always. I never expected it to happen.'' ``To express our deep respect to Mr. Abe, the nation will mourn on the 9th.''

President Phuc [Vietnam] (Book)“We deeply mourn Mr. Shinzo Abe, a leader of international renown and a great and dear friend of Vietnam.”

Former President Duterte [Philippines] (Condolences)``I feel extremely regretful and deeply saddened to learn of the untimely death of my dear friend, former Prime Minister Shinzo Abe.'' I join the people of Japan in mourning the death of former Prime Minister Shinzo Abe and condemn this senseless act of violence." "Former Prime Minister Abe was not only the first foreign leader to visit the Philippines after my presidential election, but he also visited Davao City. He was also the only foreign leader to visit my home in Japan.'' ``I will always feel that former Prime Minister Abe is close to my heart, and I will cherish the time we spent together.''

Prime Minister Lee Hsien Loong [Singapore] (condolences)``I just had lunch with Mr. Abe in Tokyo in May.'' ``I am deeply shocked and saddened.'' .”

Prime Minister Prayut Chan-o-cha [Kingdom of Thailand] (condolences)``He was talented, intelligent, and experienced,'' ``He played an important role in promoting friendly relations between the two countries,'' ``For many years, Over the years, he has worked to strengthen the relationship between Japan and the Association of Southeast Asian Nations (ASEAN).''

President Joko Widodo [Indonesia] (Condolences)“We offer our deepest condolences to the deceased former Prime Minister Abe.”

Prime Minister Hun Sen [Cambodia] (condolences)``I am deeply shocked and deeply saddened'' ``Mr. Abe was an outstanding figure who contributed to peace, stability and prosperity in the region. Politician.''

President Yun Seok-Yeol [South Korea] (condolence telegram)“I would like to express my condolences to the bereaved family and the Japanese people for the loss of a respected politician who was the longest-serving prime minister in the history of Japanese constitutional history. I would like to express my condolences.'' → What does it mean to be respected? This sparks huge criticism within South Korea.

``Forever good friend of Taiwan

Thank you for your friendship with Taiwan and your contributions to democracy, freedom, human rights, and peace around the world.

Tsai Ing-wen 2022/7/11”

(Colored paper written at the time of condolence) pic.twitter.com/VZFcnd9hfQ? Taiwan in Japan 台北駐日経済文化代表処 (@Taiwan_in_Japan) July 11, 2022

Three years of Japanese and Russian people living together in the Northern Territories - Return of the territory and current residents

Japan's territorial issues include Takeshima, the Senkaku Islands, and the Northern Territories. These three regions are completely different geopolitically, historically, in the relationship between the two countries, and in the process by which problems arise. To put the issue of the Northern Territories simply, Japan announced its surrender on August 15th, but it was officially announced on September 2nd that the Soviet Union later ratified the Potsdam Declaration, but it was not accepted internationally outside of the United States, Britain, China, and the Soviet Union. April 28, 1952, the day the San Francisco Peace Treaty went into effect. During that time, the former Soviet Union invaded and annexed the Northern Territories.

It was in 1948 that the Soviet Union ordered deportation to the Japanese islanders, so there was a period of about three years from 1945 when Soviet soldiers, Soviet immigrants, and Japanese people lived together. It is very interesting to hear the testimonies of Japanese islanders from that era.

``Russians were big and scary.'' ``Soldiers came to my house with shoes on and guns, and they said, ``Watch, watch!'' So I thought it was something, so I handed him the watch, and he said, ``Harasho, harasho,'' and was happy. So I went home.

Russian children were cute and cute and looked like angels. Her eyes were so white and big, and her green eyes were cute like a cat's. Japanese and Russian children played together, going back and forth to each other's homes. This is the testimony of former islanders and Japanese people.

I believe that former Prime Minister Shinzo Abe was the first prime minister to ask the Japanese people, who are demanding the return of the Northern Territories, where about 17,000 people currently live, whether they should expel the Russians currently living there. The Japanese people living in the Northern Territories at the time continued to demand the return of their territory, but the Russians living there never asked them to leave or take away their homes.

TSE market capitalization returns to number one in Asia - Expectations for Japan's competitiveness after withdrawal from Chinese investment?

On the 11th, the total market capitalization of stocks listed on the Tokyo Stock Exchange exceeded that of China's Shanghai Stock Exchange. It seems that the TSE has returned to the top spot in Asia for the first time in about three and a half years. Various things are being talked about, including a move away from investment in China and expectations for Japan's competitiveness to recover. In the first place, the current strange international situation is the result of developed countries investing in dictatorial countries such as China and Russia.

In 1973, the G7 once accounted for 65% of world GDP. That's the GDP of only seven countries. This was seen as a monopoly on the world's wealth, and problems in developing countries were discussed. At that time, the world was also in the era of the Cold War, but the Cold War itself was at least a better era than now. Economic and political exchanges between communist and capitalist countries were closed off and blocked by a barrier called the Iron Curtain. Russia and China are calling for a return to the Cold War era, but is that really the case? One could argue that the Cold War era was the era with the least number of wars in the world.

After the collapse of the Soviet Union, the countries of Eastern Europe collapsed one after another. China also pursued a path of liberation and reform, aiming to become an open nation. After the fall of the Berlin Wall, the world went crazy and thought the era of tension was over, but that was not the case at all. The loss of balance in the world has led to localized conflicts. Issues that were not highlighted during the Cold War era have been exposed as tensions have eased. Various things have been said about this, and while that may be true, I believe that it is essentially a matter of money.

What began with the collapse of the Cold War was global capital, or so-called globalism. Globalists are talked about as a conspiracy theory on social media, but there is no interest in knowing who is behind it. The problem is that the era when business and investment in authoritarian countries began can be thought of as the collapse of the Cold War. Did they simply think that the world would turn to democracy once communism fell? What is clear today is that the country has spent decades cultivating a state in which its domestic market is opened up to the capitalist state as much as possible, and wealth is distributed by a dictator.

The Cold War era was a great time. It was a time when the world was divided based on ideology, and it was a rational and peaceful time. The world should once again create an iron curtain of democratic and non-democratic countries. We no longer need to care how much wealth the G7 makes. Only countries that choose the democratic state form can receive democratic investment. As long as we continue to be a dictatorial nation, we should just live with the economy of dictatorial nations. You should rethink that. However, there will be some remorse for the times when we grew a nation that grew fat and threatened us with weapons.

Whether the debate on the ability to attack enemy bases is a matter of propriety, possession is an issue, or start is an issue - possession is an issue.

What is the point of the ability to attack enemy bases

1956 Ichiro Hatoyama

1999 Yoshinari Norota

2003 Shigeru Ishiba

1969 Cabinet decision

The debate over the ability to attack enemy bases has led to confusion in public opinion regarding whether it is permissible to attack enemy bases, whether it is permissible to possess such weapons, and what stage refers to the initiation of an enemy attack. appear. Looking at the government's views so far, it has consistently been stated that the ability to attack enemy bases falls within the scope of defense, and the government has also made clear its views on launching such attacks. The question is whether or not to actually own it.

Issues regarding the ability to attack enemy bases

[Possibility] Is it okay to attack enemy bases (enemy territory)?

[Initiation] What is the initiation of an attack by an enemy country (activation conditions)?

[Holding] When and what to hold

Regarding the ability to attack enemy bases, Prime Minister Ichiro Hatoyama already answered in 1956 that in the event of a missile attack, ``It is inconceivable that the purpose of the Constitution is to sit back and wait for self-destruction.'' Since then, the Japanese government has continued to interpret it as constitutionally permissible.

1956 Ichiro Hatoyama

The purpose of the Constitution is that if an imminent illegal violation is committed against our country, and if a guided missile or other attack is carried out on our land as a means of such violation, we should sit back and wait for our own destruction. I don't think I can think of it that way. In such cases, take the minimum necessary measures to prevent such attacks, for example, as long as it is recognized that there is no other way to defend against attacks by guided missiles, etc. I believe that hitting bases with guided missiles is legally within the scope of self-defense and should be possible.

In 1999, Defense Agency Director General Norota responded that the Self-Defense Forces would use the necessary force if there was a threat of an armed attack.

1999 Yoshinari Norota

In situations that do not result in an armed attack against our country, police agencies are primarily responsible for dealing with the situation, but in cases where the general police force cannot respond, the Self-Defense Forces respond by dispatching public order, and are not responsible for suppressing the situation. It's possible. Then, if a certain situation corresponds to an armed attack against our country or the possibility of such attack, a defense operation is ordered, and the Self-Defense Forces will use the necessary force to defend our country. That's why .

In 2003, regarding the launch of an attack on Japan, Director-General of the Defense Agency Ishiba announced that he would turn Tokyo into a sea of fire, and stated that if Japan began injecting fuel, this would be considered the start.

2003 Shigeru Ishiba

Now, I have a question from the committee members: There has been a statement that Tokyo will be reduced to a sea of fire, that it will be reduced to ashes, and for that purpose, in order to accomplish that, in order to make it come true. If they started injecting fuel or did something like that, then their intentions would be clear. This is a case where someone says, "I'm going to shoot this thing and reduce Tokyo to ashes," and then they just start pumping fuel, or they start making preparations, and they start taking action. Well, if you do that, wouldn't that be called a start?. That's true, because the intention is clear and that's what it is. Therefore, what I am saying is no different from what the Minister of Foreign Affairs is saying.

On February 16, 2022, Defense Minister Nobuo Kishi spoke at a subcommittee of the House of Representatives Budget Committee regarding the "capability to attack enemy bases" that the government is considering possessing. , stated that they would not rule out the option of bombing military bases, and acknowledged that it falls within the scope of self-defense.

As stated above, the government has already stated that the ability to attack enemy bases is within the scope of the right of self-defense. Regarding the next issue, ``retention'', there was a Cabinet decision in 1969.

1969 Cabinet decision

Possessing so-called offensive weapons, whose performance is exclusively used for catastrophic destruction of the enemy country's homeland, immediately goes beyond the minimum necessary range for self-defense. Therefore, it is not allowed under any circumstances. For example, the possession of intercontinental ballistic missiles (ICBMs), long-range strategic bombers, and attack aircraft carriers is not allowed.

This is the current argument for ``possession'' of the ability to attack enemy bases. In other words, the debate is whether it is a minimal weapon for self-defense or whether it exceeds it.

Since the current government opinion has interpreted it as falling within the scope of the right of self-defense, it does not fall under "offensive weapons used only for catastrophic destruction" and can be interpreted as something that can be possessed. . Until now, the government's position has consistently been that possessing the ability to attack enemy bases is within the scope of the right of self-defense, but it has not actually possessed it and has kept it ambiguous. All that's happening now is an effort to actually own it. Possession of the ability to attack enemy bases has already been deemed constitutional, and the launch of an attack by the enemy has been defined, so it would be unreasonable to now say that we are opposed to actually having the ability to attack enemy bases. The premise of the argument seems to be different.

The cabinet decision defines weapons as those used only for the catastrophic destruction of the enemy's homeland, so it is clear that this does not apply to weapons used within the scope of the right of self-defense.

Former Prime Minister Aso plans to visit South Korea and meet with President Yoon - A person who has been monitoring Japan - Korea issues from within the Cabinet

Mr. Aso visits South Korea

Mr. Aso has been observing Japan-Korea relations for a long time from within the Cabinet

The handover on the Korean side is in disarray

What will Mr. Aso offer to the South Korean regime

Former Prime Minister Aso is visiting South Korea, but the Japanese government has said that it is part of parliamentary diplomacy and not as Prime Minister Kishida's special envoy. What did Mr. Aso come to Korea for?

Mr. Aso was the prime minister who concluded the Japan-Korea currency swap during the 2008 Korean currency crisis, which occurred during the Lehman shock in the United States. After rebuilding the economy, the Lee Myung-bak administration said that Japan's aid was unnecessary. Mr. Aso subsequently served as deputy prime minister from the second Abe administration to the Suga administration. During that time, he was involved in various Japan-Korea issues, including Lee Myung-bak's landing on Takeshima, the comfort women agreement, the suspension of the Japan-Korea currency swap, the radar irradiation incident, the forced labor judgment, the comfort women judgment, and the white country issue, in his capacity as vice prime minister. Become the person you were. Like former Prime Minister Abe, he will probably be the only person who has looked at a series of issues as a cabinet member.

Meanwhile, in South Korea, the government changed from Lee Myung-bak to Park Geun-hye, and after impeachment, came the Moon Jae-in government, which removed all people who were said to be pro-Japanese from diplomatic relations. After that, he launched a series of anti-Japanese movements, leading to the current Yun Seok-Yue administration. In other words, on the South Korean side, there is no continuity in Japan-Korea relations, the handover is probably fragmentary, and it is highly likely that they do not understand anything other than symbolic concerns.

It would not be surprising if Japan-Korea relations contain a variety of other problems in addition to those that have been made public. If the problems that have come to light are just the tip of the iceberg, Mr. Aso is probably the person who knows the various problems and background behind them. In other words, it is highly likely that the meaning and content of the comprehensive solution that South Korea calls and the comprehensive solution that Japan thinks of are different.