National debt is not the people's debt - The country is not a company - Breakdown of government bond holdings that still do not penetrate public opinion.

2024-01-09

Category:Japan

「国債等関係諸資料」令和5年6月末国債保有内訳 Photo by 財務省 (licenced by 財務省 )

I'm participating in the ranking.Please click and cheer for me.

National debt is not a national debt.

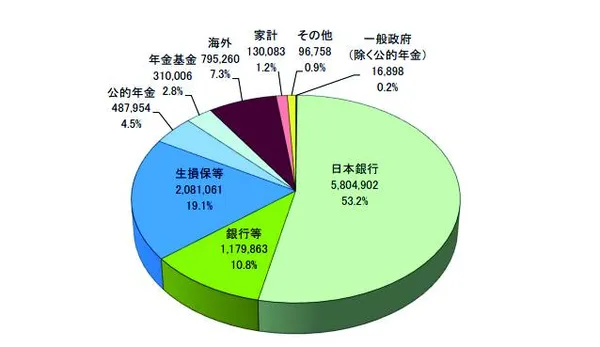

The image at the beginning shows the breakdown of Japanese government bond holdings. I sometimes see people say that national debt is the nation's debt or that it is the same as corporate debt, but national debt is the government's debt, not the people's debt. Even if a country is compared to a company, companies do not borrow money from their employees. Debt comes from outside the company, and in this case, it involves purchasing Japanese government bonds from overseas. If most of the debt is overseas, it is natural that the company will default if it cannot be repaid. Purchases of Japanese government bonds from overseas account for 7.3%.

The Japanese government has assets equivalent to its liabilities.

If you really want to say that it is the same as a company, would you say that purchases in Japan are borrowed and borrowed within the company or within the group company? Yoichi Takahashi considers the Bank of Japan to be the same as a subsidiary of the government, and explains that it is the same in terms of consolidation, regardless of whether interest is charged. The Bank of Japan holds 53.2% of Japanese government bonds. He is well known for introducing BS to show that the country holds government assets equivalent to the government's debts (excluding the holdings of the Bank of Japan). The total amount of government assets ranks first in the world, exceeding both the United States and China. Below is the balance sheet (BS) of Japan.

#img2#

Japanese government bonds are debt denominated in yen.

Furthermore, Japanese government bonds are mainly traded in yen, which means that there is no change in value based on foreign currencies. In the case of foreign currency transactions, if the value of your home currency plummets, the face value of your debt will rise accordingly. Suppose your country's currency drops to half its value. Alternatively, if the foreign currency used when trading government bonds doubles, the debt will also double, but since the transaction is in Japanese yen, there will be no effect at all. In an extreme case, former Prime Minister Aso said that repayment would be possible by increasing the number of yen bids. In this case, there will be inflation and the value of the yen will fall, but the theory is that the debt can be repaid because it is the face value of the yen. This was actually said by Taro Aso, a former Prime Minister and former Minister of Finance.

Japan, the world's largest creditor country

Secondly, the Japanese government is also the world's No. 1 creditor country. In other words, they have foreign bonds and foreign assets. The fact that we are currently talking about national debt as a problem is actually making a fuss about only the debt part, and in fact, Japan has the most foreign assets in the world. This assumes that the government bonds are denominated in yen as mentioned earlier, and if more yen is printed, the value of the yen will fall and the yen will become weaker. If you do this, overseas assets purchased in dollars or euros will increase in value when converted to yen, so the difference will be a large income. Even with the current depreciation of the yen, a large profit margin was generated due to the increase in the valuation of overseas assets.

Print more yen up to 2% inflation rate

Representative Sanae Takaichi has advocated the ``Japanese Economic Resilience Plan,'' which calls for a temporary freeze on primary balance (PB) regulations and calls for industrial investment through the issuance of government bonds. She says that even if inflation were caused by printing more yen, it would not have a big impact if the inflation rate was less than 2%. Currently, the yen is depreciating due to the difference in interest rates due to the Fed's interest rate hikes, but the original goal is to induce a depreciation of the yen through the issuance of government bonds and increase the number of bonds, strengthen international competitiveness, and increase wages and tax revenues through rising prices. If the manufacturing industry returns to Japan due to the weak yen, GDP and tax revenue will increase, and government debt can be reduced. For now, this is just the effect of a weaker yen due to interest rate differences, but we are already seeing significant results.

Read it together

Public opinion without examining Abenomics - there is no point in criticizing it based on contradictory premises.

There are some surveys and opinions in public opinion that Abenomics has ruined Japan, but is that true? First of all, what is Abenomics? Were you asking people who answered the same question as in the poll, or were you asking people you didn't know? I wonder if asking someone I don't know will give me the results I expected. First, let's review the three arrows of Abenomics.

Three arrows of Abenomics

Bold monetary policyFlexible fiscal policyGrowth strategy to stimulate private investment

Monetary policy is still ongoing, but former Prime Minister Abe has said that the consumption tax increase was decided in advance and was carried out at a time when it could not be postponed, so he was unable to fire a second arrow. In other words, Abenomics is actually the first arrow in a variety of environments. In other words, I would understand if there was an evaluation of the fact that it did not advance to the second stage, but I have doubts about evaluating Abenomics itself.

Next, I will list some of the achievements of Abenomics.

Main achievements of Abenomics

The total national and local tax revenue will reach a record high of 107 trillion yen in fiscal 2019, up from 78.7 trillion yen in fiscal 2012. The stock price, which was around 8,000 yen, rose to over 24,000 yen under the Abe administration. Public pension investment profits increased by 57.6 trillion yen in seven and a half years. The effective job opening ratio was 83 job openings for every 100 people in 2012, and 164 job openings for every 100 people in 2019. Business operators improved their treatment due to the labor shortage. The minimum hourly wage rose from 749 yen in 2012 to 901 yen in 2019. The rate of children from single-parent households going on to university increased significantly from 23.9% to 41.9%.

Sanaenomics (Japanese Economic Resilience Plan) will be published. Representative Sanae Takaichi announced a policy to carry on Abenomics during the last presidential election.

Sanaenomics three arrows

Financial easingFlexible fiscal stimulus in times of emergencyBold crisis management investment/growth investment

What they have in common is that monetary easing policy will continue, and if the Takauchi Cabinet is elected, the government will implement aggressive fiscal policy.

The fact that the Japanese government's balance sheet was introduced for the first time in 1995 means that the Japanese government did not have the concept of strategic investment, which companies take for granted. How can you invest without a balance sheet or cash flow statement? It was only a matter of being able to compare the income and expenditure for a single year, or the previous year. The term "primary balance" has come to be used like crazy. At that time, Japan believed that deregulation would revive the economy, and the government repeatedly took the approach of relaxing regulations through legal revisions.

As a result, the Japanese government was unable to rebuild the national economy or make strategic investments for economic growth after the collapse of the bubble, which was an unprecedented economic crisis. More than 30 years have passed since we stubbornly closed the doors. Then, companies moved their manufacturing sectors to emerging countries, and GDP and tax revenues mainly went to neighboring countries such as China, creating a dual wage structure of dispatched labor in order to prevent an increase in the number of unemployed people in Japan. . The economic disparity that arose from this process is said to be one of the causes of the current declining birthrate.

So, has Abenomics ruined Japan? Would that also mean denying Sanaenomics? Or will we continue to turn down investments from the government as we have been doing, paying close attention to the primary balance under the guidance of the Ministry of Finance and listening to the beautiful words of fiscal consolidation? The point of contention should be to gather opinions on whether or not bold fiscal spending by the government is necessary. In any case, regardless of whether the policy is better or not, there are parts where it seems like the point at issue is not policy at all, but just an extension of a personal attack, which is unfortunate.

30 years lost as a result of passive fiscal policy

In other words, those who claim that government debt is bad have the completely opposite idea. What ruined Japan after the bursting of the bubble was rather the primary balance discipline, the inability to focus on single-year income and expenditures and to make long-term investments. Japan tightened its finances in the most critical economic situation. If it is the same as a company, when the company is in crisis, the company's safe is closed like a shell, and for the past 30 years, the company has been operating in a state of poverty and not being able to make long-term investments. This is the so-called curse of PB by the Ministry of Finance.

I'm participating in the ranking.Please click and cheer for me.

The political reform outline of 1989 has become a mere shell - What is Prime Minister Kishida's formulation of

One faction after another announced that they would be disbanded, and Prime Minister Kishida also mentioned the dissolution of the Kochi-kai. Looking at the Political Reform Outline drawn up in 1989, we can see that it does little to address the current party ticket issue. This is an outline adopted by the Liberal Democratic Party in the wake of the Recruit Incident. Prime Minister Kishida has said that he will formulate "new rules," but what is the position of the political reform outline that his own party has drawn up in the past? You can read the full text of the outline by clicking on the link, but here we will describe the table of contents and main points.

Excerpt of the Political Reform Outline

Revising and strengthening the Code of Conduct and the Political Ethics Review Board

Enactment of law to disclose assets of members of the Diet to establish political ethics

Strengthening the ban on donations to ceremonial occasions, etc.

Regulations on business card advertisements, New Year's cards, etc.

Strengthening regulations on posters, etc.

Reducing personnel and office costs

Stock trading regulations

Restraint of parties and new regulations

Concentration of donations to political parties and support for member activities

Expansion of public aid to members of the Diet and examination of political party laws focusing on state subsidies

Fundamental reform of the electoral system

Reduction of total constants

Correcting disparities

Fundamental reform of the electoral district system

Exercising the uniqueness of the House of Councilors

Reform of the current proportional representation system

Reducing the total number of constants and correcting the imbalance in the allocation of constants

Enhancing deliberations and easy-to-understand parliamentary management

Respect for majority rule

Achieving efficient parliamentary management

Determination to remove and eliminate the harmful effects of factions

Transition to a modern national party

Reflections of tribal members

Improving the number of winnings system and ensuring that rewards and punishments are mandatory

New rules for determining candidates

Establishment of decentralizationMay 23, 1989 Political Reform Outline

Has anything been achieved in this? Looking at the recent party ticket issue, it appears that it has largely faded away, but Prime Minister Kishida recently announced that he is considering disbanding the Kochi-kai. Mr. Nikai's Shijo-kai has announced that it will be disbanded, and the Seiwa-kai, which started it, will also be disbanded. Was it because of the faction itself? In short, it was probably a matter of not reporting political funds. Looking at public opinion to date, it appears that the majority opinion was that the existence of factions themselves was not a problem as a forum for policy discussion, and the prosecutor's investigation also focused on undocumented issues.

Prime Minister Kishida has said that he will create new party rules while dissolving factions, but first he will create check items from this political reform outline and evaluate each item in stages to see what has been achieved and to what extent. Why not consider it? Instead, they will consider "new rules."

The negative reason for the creation of factions is related to the structure of the parliamentary cabinet system. Personnel decisions within the party are all about internal party theory, and almost everything is shaped by interpersonal relationships. Your treatment will change depending on which trend you go with. Since the prime minister is the leader of the largest ruling party, the choice of leader is based on internal party theory and is determined by votes from party members based on their factions. On the other hand, if we adopt a dual representation system, no matter how many theories we create within the party, the top positions are decided by the people, so there is little point. It is said that in the United States, which has a presidential system, there are almost no cliques like there are in Japan.

It is said that one of the reasons why Japan has adopted a parliamentary cabinet system is to limit the authority of the top government. The reason is that they do not have much authority in the sense of reflecting on past wars after defeat. For this reason, Japanese politics takes a very long time to make decisions. In that sense, it can be said that the system is very vulnerable to emergencies. In a dual representation system, the people choose the top person, so the quality of their votes is different from that of other members of the Diet. Furthermore, the number of votes that would be obtained based on the assumption that all citizens would participate in the vote would be vastly different. Members of the Diet are simply elected in the regions in which they run for office. For this reason, the president is given greater authority than the prime minister, who is elected by members of the parliament. This authority also exerts great power in emergencies.

Is the party ticket issue the result of a sound whistleblower? In Japan, a spy paradise, you can do whatever you want.

The public prosecutor's office is said to be looking into the party ticket issue, but the main concern is the source of the leak. The original story is an article in the Japan Communist Party's Red Flag Newspaper dated November 6, 2022, but it feels strange that a specific group is being hit in a domino pattern like this. We have seen a pattern in the past in which scandals are discovered one after another within the administration, resulting in a decline in approval ratings. I always wonder who is leaking this.

Japan is said to be a spy paradise, but how many spies are there in Nagatacho? I have no idea how many people are from which country or from which country. Since GHQ was involved in the central government of Japan under trusteeship, some people say that by extension it has a thorough understanding of the system, and that the CIA and others continue to infiltrate and collect information. This is not to say that whenever problems occur in Japan, it is the work of spies, but rather that they could easily do it if they wanted to.

If another country is in charge of a scandal involving a Japanese politician, and it becomes inconvenient, should we leak it?

In China, I sometimes hear people say that Xi Jinping is a smart leader because he advocates eradicating corruption, but this is ridiculous. It can be said that the anti-corruption movement is what created Xi Jinping's dictatorship. Xi Jinping has monopolized real power by eliminating political opponents one after another on the grounds of corruption. In addition, no one can say anything because they have the public security thoroughly investigate corruption by all Communist Party members, have evidence gathered, and arrest any strange behavior. Corruption-free cases in China are rare, so it's like almost everyone is threatened.

From the perspective of these countries, it seems easy to infiltrate Japanese politicians' personal secretaries, public secretaries, accountants, etc. with intelligence agents. Is Japan already so suppressed in various areas that it cannot even enact an anti-espionage law? At the very least, there is no doubt that corruption is a no-no, but if espionage from other countries is allowed to do whatever it wants, it would be as if Japanese members of Congress were also held hostage.

It is necessary to solve the problem of political funding fraud, but if information management is sloppy, there will be no problem.

Prime Minister Kishida sends off his visit to Yasukuni Shrine - a place beyond Japan's sovereignty.

I will not visit Yasukuni again this year

Current Prime Minister visited Yasukuni Shrine after the war

Where no incumbent national leader can step foot?

Yasukuni Shrine is not a border issue

Violation of national sovereignty, not historical issues

Historical issues cannot be resolved without sovereignty

Prime Minister Kishida refrained from visiting Yasukuni Shrine and paid the tamagushi fee with his own funds. Some people in other countries even think that Yasukuni Shrine is located outside of Japan. This is because the leaders of a country cannot imagine that there are public places within their country that they cannot set foot in.

[Current Prime Minister who visited Yasukuni Shrine after the war]

The 43rd King Higashikuninomiya Toshihiko

The 44th Kijuro Shidehara

45th, 48th-51st Shigeru Yoshida

56th-57th Nobusuke Kishi

58th-60th Hayato Ikeda

61st-63rd Eisaku Sato

64th-65th Kakuei Tanaka

66th Takeo Miki

The 67th Takeo Fukuda

68th-69th Masayoshi Ohira

70th Yoshiyuki Suzuki

71st-73rd Yasuhiro Nakasone

82nd-83rd Ryutaro Hashimoto

87th-89th Junichiro Koizumi

90th and 96th Shinzo Abe

Will President Xi Jinping be able to visit Taiwan? I wonder if it can't be done? People from outside would normally think that if it can't be done in the first place, then it's not China. A sitting president cannot set foot in certain parts of the United States. Everyone would think that this is an area beyond the reach of American sovereignty.

In areas and islands with territorial disputes near borders, there are places where national leaders cannot set foot. In Japan, these include Takeshima, the Senkaku Islands, and the Northern Territories. However, former South Korean President Lee Myung-bak has landed on Takeshima, and former Russian Prime Minister Medvedev has visited Etorofu Island. Their only purpose is to assert national sovereignty.

Let's say that the reason the Japanese prime minister does not visit these areas is to avoid border disputes. But Yasukuni Shrine is located in Tokyo, the capital of Japan.

Before discussing what the Yasukuni issue is, the problem is that it obscures the fact that it is under the sovereignty of the Japanese state. In other words, other countries are restricting Japan's sovereignty by giving orders to the current leader, the prime minister, to visit public facilities in the capital of Japan. Yasukuni Shrine is originally a Japanese religious facility within Japan, and anyone is welcome to visit it.

Whether or not it is a problem because it enshrines a class A war criminal is not for other countries to decide in the first place. This can also be said to be Japan's decision under its sovereignty as a nation. It would be different if Yasukuni Shrine was located in China or South Korea.

A summary of impressions of the numerous candidates competing in the 2024 Japanese LDP presidential election

As the LDP presidential election draws near, candidates are coming forward one after another. Ishiba Shigeru, Kobayashi Takayuki, Hayashi Yoshimasa, Takaichi Sanae, Kono Taro, Koizumi Shinjiro, Aoyama Shigeharu, Mogi Toshimitsu, and Kamikawa Yoko (in no particular order) are some of them. Among them, Ishiba, Kono, and Koizumi are the ones who are frequently mentioned in the media, so perhaps they are the ones who are getting the media votes. Ishiba has little conservative thinking, such as accepting a female emperor or promoting separate surnames for married couples, and has a strong liberal tendency, so much so that some have mocked him and asked him if he should transfer to the Constitutional Democratic Party.

The issue of imperial succession has already been narrowed down to two proposals by a panel of experts: "a proposal for female members of the imperial family to remain in the imperial family after marriage" and "a proposal for adopting a male member of the former imperial family as a son in the male line." A report has been sent to the Diet. Since Prince Hisahito was born, there has been no consideration of a female or female-line emperor, and they are moving towards the idea of ??adopting a male in the male line. In response to this, the Speakers of the House of Representatives and the House of Councillors, as well as the leaders of each party, have gathered to hold discussions since May 17th, but even LDP members have ridiculed Ishiba's comments as being table-top-turning.

As for the separate surnames for married couples, one of the issues that was initially pointed out was that it would be difficult to change back to the maiden name in administrative agencies, financial institutions, and other procedures upon divorce, but the law has been revised to allow the use of maiden names without making any major changes to the family registry system, so I wonder if the discussion is a bit outdated, or if the comments are just for the media.

As for Takayuki Kobayashi, he is a conservative who supported Sanae Takaichi last time, but his way of thinking is almost the same as the late Abe and Takaichi, and as a result, I get the impression that he has less impact. In that case, Takaichi will likely be chosen, but as a young candidate, she may be a good candidate to reduce Koizumi's party member votes.

As for Kono Taro, he scrapped the Aegis Ashore deployment plan when he was defense minister, and in the last presidential election, he expressed opposition to the possession of enemy base attack capabilities, and as a result, he presented himself as a pro-China politician without even thinking about it, and I remember him suffering from severe burns all over his body, but he seems to be running, and it seems like his expiration date has already passed, and voters are getting tired of him.

I can't think of any notable achievements for Koizumi Shinjiro, and perhaps his popularity is due to his father's use of words that are conscious of the message he uses, but in any case, he seems unable to break away from his base of anti-nuclear power and clean energy. He is recommended by Suga, but I can't help but wonder if there are energy interests in Kanagawa Prefecture.

Mr. Motegi seems to have a clear mind, which is a good point, but he has mentioned local voting rights for foreigners several times, and I get the impression that he has a strong left-leaning tendency. Looking at Europe, many countries do not allow non-EU nationals to vote in local elections, and there are also cases where only certain non-EU nationals are allowed. Only Northern Europe grants voting rights to non-EU nationals. If we think about it this way, what kind of foreigners are in Japan? As for the proposal to grant voting rights to Chinese and Koreans from anti-Japanese countries, I have serious doubts about the logic that Europe is the model for.

As for Mr. Aoyama Shigeharu, I agree with his historical awareness, etc., and I would like to support him as a patriot, but the fact that he is a member of the House of Councillors is a problem. There is no precedent for a member of the House of Councillors to become prime minister and party president, and there is an inevitable contradiction in whether a member of the House of Councillors has the right to dissolve the Diet. There is no dissolution of the House of Councillors, and dissolving the House of Representatives means resignation, which means that all members are dismissed and lose their seats, but the Prime Minister remains a member of the Diet. He says he will "ask the people for their trust," but he will not be asked to run for the House of Representatives, so I hope he will switch sides and run for the House of Representatives.

I can't think of anything about Yoshimasa Hayashi or Yoko Kamikawa. I've heard that Hayashi is a pro-China member of parliament, and I have the impression that Kamikawa is a foreign minister who won't budge no matter what China does or says to him. It could be said that Kishida's side is putting up a female candidate as a rival to cut Takaichi's votes.

Takaichi has inherited the policies of the late Abe, and has further developed them. She will not talk about old-fashioned things like denuclearization, but will instead propose pioneering policies such as investment in fusion reactors and industrialization. It is also necessary to increase the inflation target to 2%. Currently, the yen is weaker due to the interest rate differential, but this is not due to the bill increase, it is simply the value of the yen falling. As a result, the inflation rate will be achieved and export competitiveness will increase, but unless the total amount of bills increases, it will be difficult for the face value of wages to increase. The Federal Reserve has already announced at the beginning of the year that it will lower interest rates at the end of the year, and if Trump becomes president, it is unclear whether the current situation will continue. If the interest rate differential decreases and the yen tends to appreciate, I would like to see the original inflation rate of 2% achieved by the bill increase. Regarding security, Takaichi clearly advocates investment in the military industry, and has a vision of imagining and nurturing new industries. She has the most concrete and strategic ideas.

Is the Unification Church issue a problem of separation of church and state? - Abnormal public opinion that condemns people just by saying hello.

The problem started with the murder of the former prime minister

There is no law that says no to politicians getting involved in religion

What are the benefits of specific religions from the country

Incoherent media tone

The issue of the Unification Church has become somewhat incomprehensible in Japan. It is said that the mother of the person responsible for the incident in which former Prime Minister Abe was shot and killed was a member of the Unification Church, and that her past misfortunes related to this were the motive behind the incident. Former Prime Minister Abe reportedly gave a speech at the Unification Church. However, this is still just a statement before the trial. I don't even know if that's the real motive.

Politicians are often asked to attend and give speeches at meetings of various organizations. It can also be said that this is part of political activity. Some people refer to the constitutional principle of separation of church and state, but when interpreted as a law that prohibits the state from providing benefits to specific religious groups, it can be interpreted as a law that prohibits individual politicians from drinking alcohol, regardless of which religious group they greet at. It's not something I already know.

Facilitation by the state refers to the provision of advantageous systems and benefits to specific religious groups by law. Even if they say hello at the Unification Church, they will probably also visit Yasukuni Shrine, and if the Dalai Lama of Tibetan Buddhism visits Japan, will the Japanese Prime Minister meet him? He will probably meet the Pope when he visits Japan. Does this violate the principle of separation of church and state? We just met.

The problem with the Unification Church is simply a question of how to regulate large donations to religious organizations that violate public order and morals, as well as forced requests, and is far from an issue of the separation of church and state.